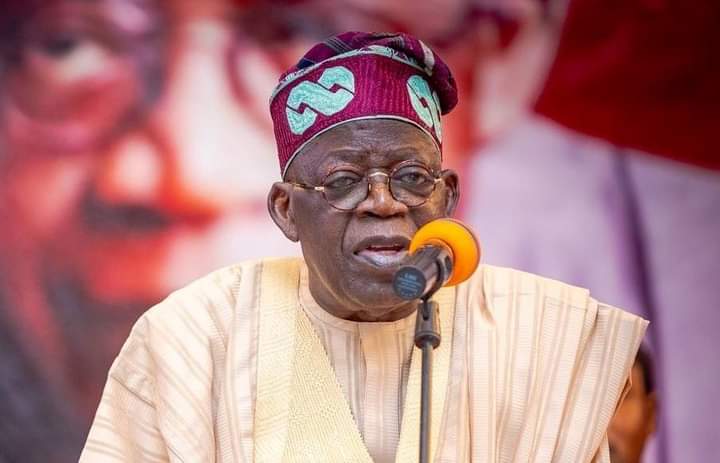

A prominent member of the ruling All Progressives Congress (APC), Dr. Abayomi Nurain Mumuni, has expressed support for the proposed tax reform introduced by President Bola Ahmed Tinubu, stating that it is designed to increase revenue generation and create more jobs in the country.

In a statement issued on Tuesday by his media aide, Rasheed Abubakar, Mumuni explained that the tax reform bills, recently transmitted by Tinubu to the National Assembly, would strengthen the country’s fiscal framework.

Mumuni emphasised that once passed into law, the reforms would promote economic growth, with key benefits including enhanced revenue generation, economic diversification, attraction of foreign investments, and improved public services.

The statement said: “Here are some potential benefits associated with the bill. Increased Revenue Generation. The reform aims to broaden the tax base and improve compliance, leading to increased government revenue for public services and infrastructure.

“Economic Diversification. By encouraging investments and reducing reliance on oil revenues, the bill supports diversification into sectors like agriculture, technology, and manufacturi

“Attracting Foreign Investment. A more transparent and predictable tax system can make Nigeria more attractive to foreign investors, fostering economic growth. Job creation. Increased business activity and investment can lead to job creation, reducing unemployment and poverty levels.

“Improved Public Services. With higher tax revenue, the government can better fund essential services such as education, healthcare, and infrastructure development. Support for Small and Medium Enterprises (SMEs). The bill may include provisions to simplify tax processes for SMEs, encouraging entrepreneurship and innovation.

“Strengthened Tax Administration. Reforms could enhance the efficiency and effectiveness of tax collection mechanisms, reducing corruption and leakages. Fiscal Responsibility. Strengthening tax policies can promote fiscal discipline, helping the government manage its budgets more effectively.

“Enhanced Economic Stability. A reliable tax framework can contribute to overall economic stability, making Nigeria less vulnerable to external economic shocks. Promotion of Social Equity. Reformed tax policies can ensure that wealthier individuals and corporations contribute their fair share, promoting a more equitable society.

“Overall, these reforms aim to create a more favorable economic environment in Nigeria, benefiting both the government and its citizens.”